-

The Locker Manager Provides solution for managing locker of the client. It consists of sub modules that give the ability to handle the locker the client holds. This feature allows client to be hassle-free considering their locker as the client is provided with the interface through which they can handle their locker respectively. Locker Manager has many inbuilt features which have an advantage to the client using it. This module is only bound to some regions.

Core Aspects

-

We provide a quality leading solution of passbook printing which encompasses the modules for managing the printing of passbook. This module mainly features the printing of transactions carried out of a user’s account on a passbook. Passbook printing offers built in functionality that enables the user to modify the configurations of the passbook printing that are changeable. It perfectly prints any passbook whose configurations are up to date.

-

Daily Deposit agent application is mainly for the agents who collect daily deposits from the account holders. This application comprises of the functionalities that an agent of daily deposit can operate. Daily Deposit Agents can easily maintain their daily collections with the help of this application. Daily collections are harder to manage in day-to-day work routine. This application provides tense free management of the daily collected amount by the agents from the daily deposit account holders.

-

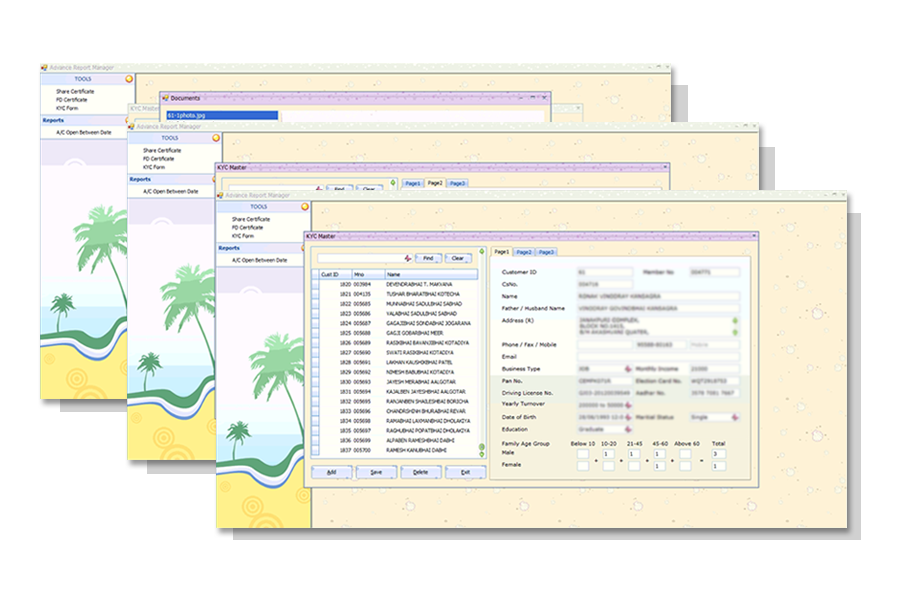

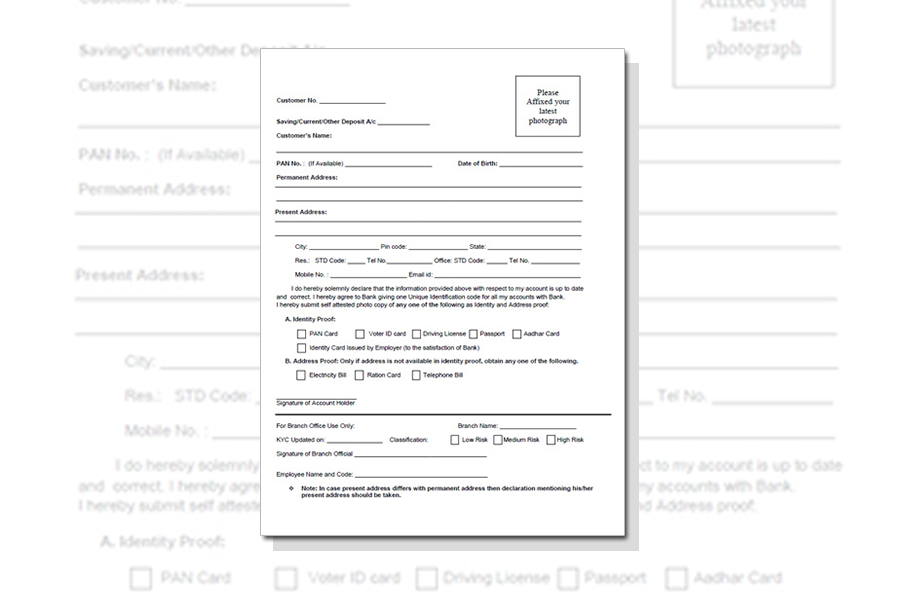

The KYC Module provides a wide range of analyzed information of the clients. KYC known as ‘Know Your Customer’ is a procedure by which a bank obtains the information of its customers. This is done so as to ensure that the services of the bank are not misused. The KYC information is periodically updated. The KYC module provides various functions such as accepting new information, updating existing one and removing the old information.

-

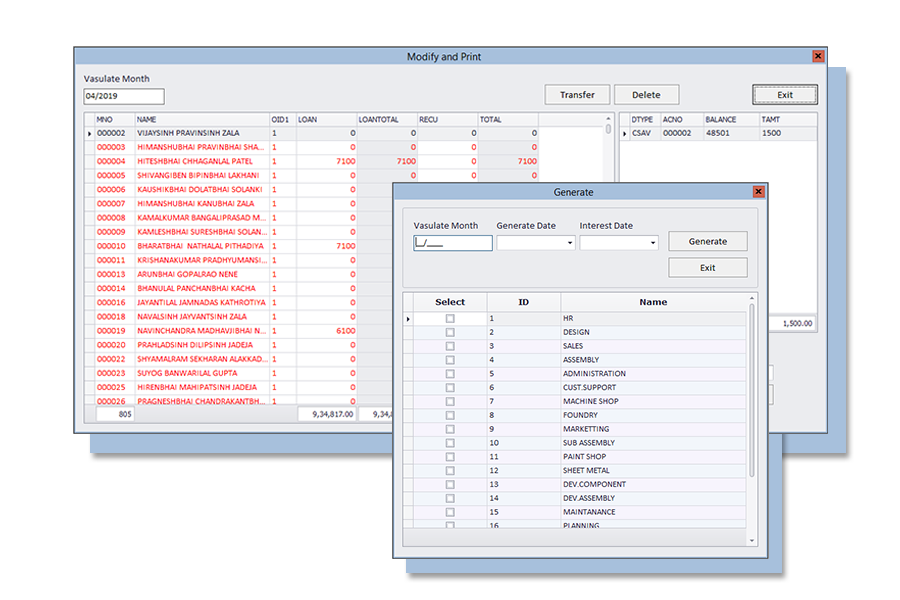

Vasulat patrak is mainly for the Employee Credit Societies. Vasulat Patrak is a recovery register that is generated at the end of the year. The members of the Employee Credit Society are the employees themselves. Whenever an employee takes a loan from the society, the installments that are to be paid are totally recorded in the vasulat patrak. The vasulat patrak also consist of the total daily deposit amount the employee has to pay if he/she holds a daily deposit account.

-

We provide the functionality of adding custom commission and managing it. Agents are given fixed amount of commission on a certain amount. Customized commission is possible with the Customized Commission Manager. It generally provides the altering of the commission that is to be given to the agent. Commission such as 10% on a particular amount is fixed for the agent, so whenever alteration is needed as per need, the commission can easily be customized a different rate.

-

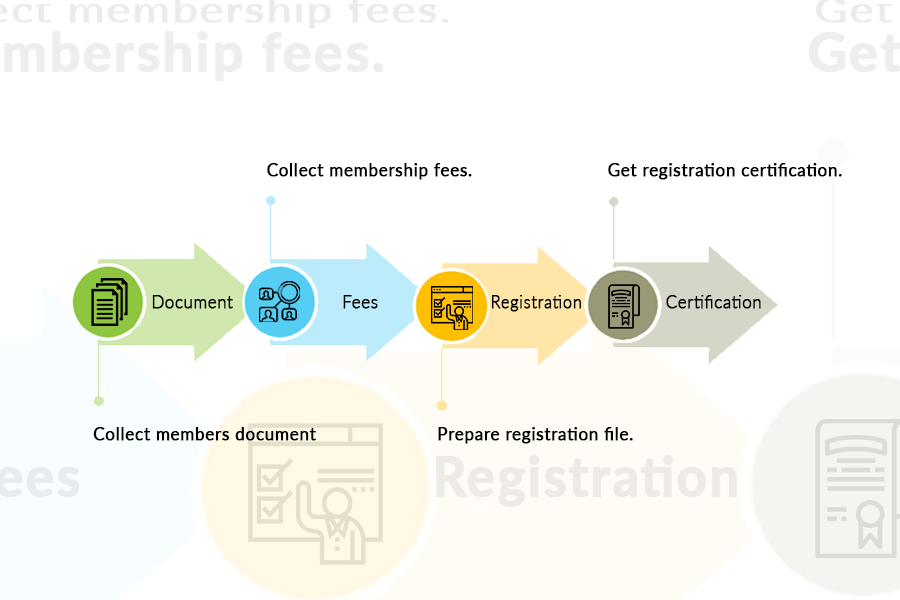

We provide the quality service of registration of societies in a specified region only. The society registration goes through a sequence of procedures that is collecting member’s documents, membership fees as specified, prepare registration file and at last get the registration certificate.

-

We provide the hassle-free way through which one can download and refer to various forms such as loan form, FD Interest certificate, Loan interest certificate, Loan NOC, Training form & Member form. These forms can be accessed from our site page. One has to log in to be able to download to these forms. If the person is not registered then he/she has to register and then log in with the appropriate credentials.

-

General rules are the rules and regulations for a credit society. Such as maximum amount of loan it can lent to the members. These general rules and regulations should be strictly followed by every credit society. We provide the information about the rules and regulations that should be followed when establishing a credit society. When establishing a credit society, one should know about the rules and regulations that constitute the base of credit societies.

-

PetaNiyam are the norms and the rules of a credit society. Petaniyam Sudharana is done when there are changes that need to be done on the norms. Hence, we provide this service of making the change in the petaniyam of a credit society. Whenever a credit society is established rules and regulations are set. Later when changes are needed in the rules and regulations, a particular procedure needs to be followed. We provide the service of the procedure that needs to be followed whenever these changes need to be done.